The electric vehicle (EV) market is growing at a healthy rate, driven by the need to reduce the global warming influences contributed by internal combustion engines (ICE). EV batteries have high nickel content. The Nickel Institute commissioned Avicenne Energy to conduct a multi-country study to understand the factors that influence the EV market.

About the study

Europe currently leads the world in the rate of EV adoption and in the total number of electric vehicles sold. Historically, Europe accounts for about 15% of the global light automotive market but in 2020 it accounted for 43% of all battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEVs) sold, amounting to an increase of 140% over 2019. In contrast, the United States which accounts for about 20% of global car sales was responsible for only 10% of the worlds EV and PHEV sales.

Avicenne looked at the total cost of owning an electric vehicle in Europe to understand whether there is a financial motivation to owning an EV in Europe.

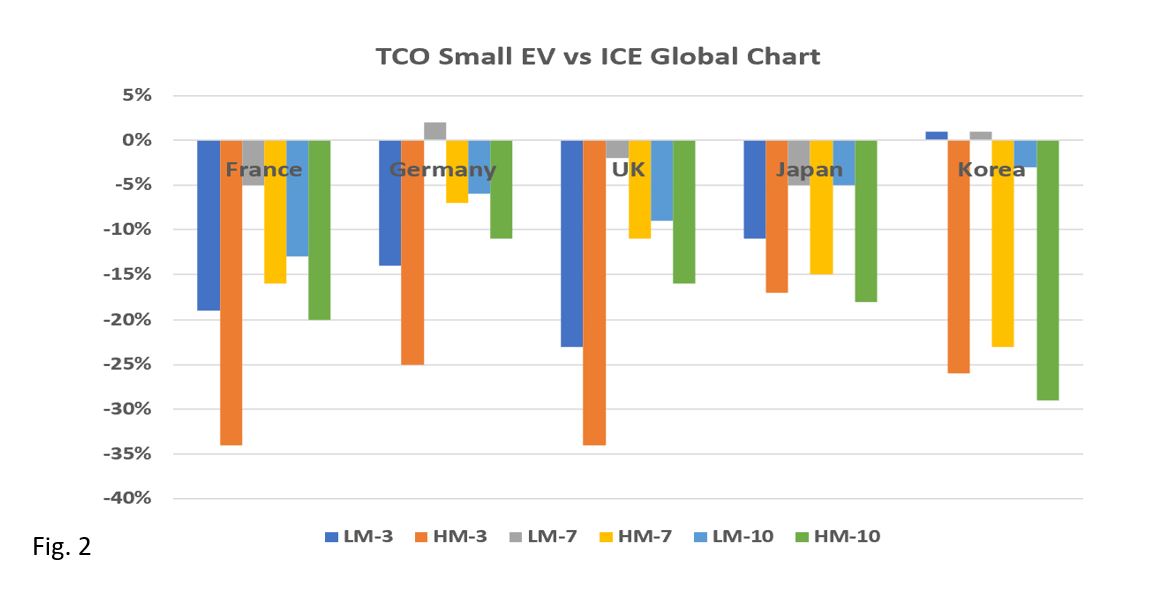

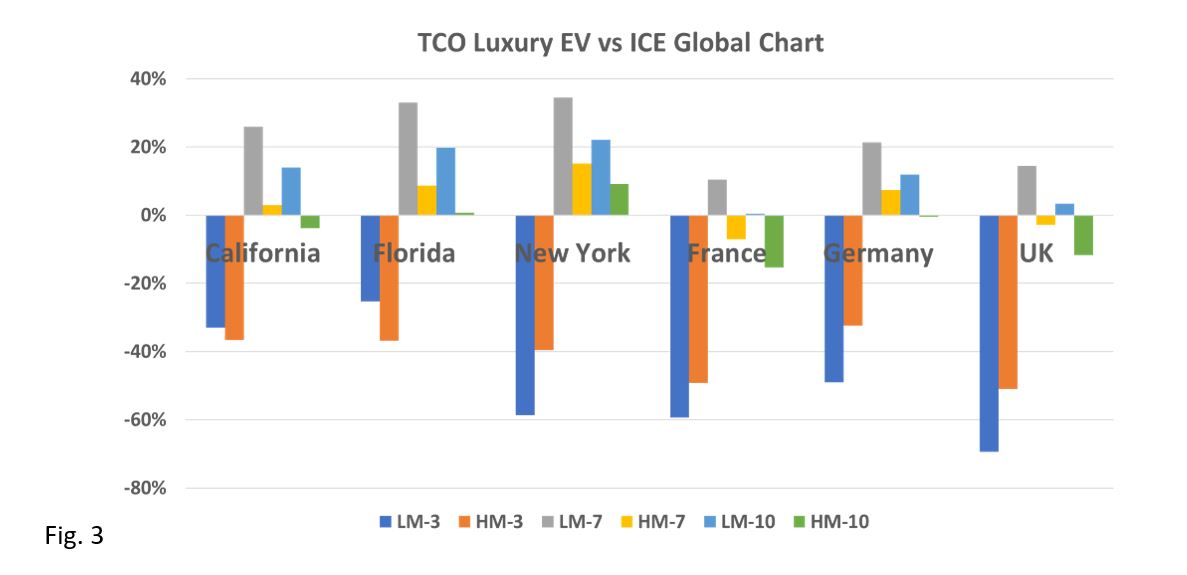

The total cost of ownership (TCO) varies dramatically across the globe and can vary significantly between countries within any given region.

For this European study, Germany, France, and the UK were investigated since they are the three largest European markets.

The cars chosen for this report represent three classes, small, mid-size, and luxury and in each class the vehicles were chosen to represent (as much as possible) common domestic offerings with equivalent options. Tesla S, chosen in the luxury category is the only non-domestic model.

Report Summary

The total financial cost of owning an EV in Europe could be a compelling advantage to the consumer for most vehicle models, particularly in small and mid-size vehicles.

Individual EU countries have significant differences with respect to, subsidies, taxes, and incentives when purchasing an EV which can make a major difference, representing up to 20% of the purchase price in some cases.

Small and medium sized electric vehicles have a clear advantage over ICE vehicles due to their subsidies and residual value but also due to the high cost of petroleum and diesel. Petroleum costs in the European countries investigated are 1.5 to 2.8 times more expensive than in the USA.

Contrary to smaller vehicles, luxury vehicles can have an extreme gap in the purchase price, (Tesla S, 81,990 Euro vs. BMW 5 series, 47,700 Euro). This price difference offsets the high cost of petroleum and for high mileage drivers, the TCO for EVs can be higher than for ICEs. In addition, the high cost of electricity in Europe increases the cost of EVs with large batteries. The cost of electricity in the EU countries investigated is 1.4 to 3.3 times more expensive than in the USA.

Germany having the highest electricity costs and the lowest petroleum prices, tilts the EV TCO closer to an ICE than in other countries, but there is still an advantage for most EV models.

In general, the electricity from public chargers is twice the cost of home charging and consequently full public charging will be kept to a minimum.

Download the report