It has been widely reported recently that Tesla will start using Lithium Iron Phospate (LFP) technology (from Chinese battery producer CATL) in their Model 3 manufactured in China. Although not yet confirmed by Tesla, the use of LFP over Nickel Manganese Cobalt (NMC) makes sense from a purely cost perspective. In China, the price of LFP cathode active material (CAM) from CATL is 43% less expensive, (per kWh), than their NMC811 material. And considering that the cathode is by far the most expensive component in the battery, this difference in active material cost can have an important impact on the final cost of the battery going into the electric vehicle.

Battle of the batteries - Cost versus Performance

The last three months have been unprecedented. But amidst the chaos and despite the drop in global GDP, there has still been a considerable amount of activity in the electric vehicle (EV) and battery world.

LFP and NMC - cost versus energy density

However, while there is an upside on cost, the significant downside for LFP is energy density, which is only 65% - 70% that of MNC811 (depending upon packaging). This means that to achieve the same driving range, the physical size of an EV battery would need to be one third bigger – a concern in vehicles where space is at a premium. An LFP-powered Model 3, using the same battery space as the current version, should have around 66% of the NCA range.

Certainly, if Tesla is using LFP, the motivation is to lower cost, so the electric vehicle is more affordable to more people. Also, subsidies for new EVs in China only apply to cars with a price tag under 300,000 yuan. To qualify, the price of the Model 3 would have to drop by 20% to 25% of 2019 prices.

In China, a minimum energy density of 140 Wh/kg at the battery pack level (not cell) is also required for government subsidies. Using LFP in a traditional battery pack design doesn’t quite get to this 140 Wh/kg level and so a redesign is necessary to optimise space and weight.

While there is an upside on cost, the significant downside for LFP is energy density, which is only 65% - 70% that of MNC811.

Cell to pack technology

CATL and competitor BYD have both announced new LFP pack designs that are significantly more efficient, yielding over 140 Wh/kg. The new design has been termed cell to pack (CTP) technology. While there are design differences, both companies essentially use a very large prismatic cell which allows for more effective cell packing and cooling systems, much fewer connections and simpler battery management systems. Compared to the Panasonic NCA cylindrical cell that is currently used in all Tesla cars outside China, the new CTP design reduces the number of connections and circuits by a factor of 200 – resulting in a much cheaper battery. The use of LFP and CTP should translate into a vehicle that ticks all the boxes for the Chinese market.

Pack design using large prismatic cells is also being pursued outside China. The GM and LG Chem relationship has resulted in the Ultium battery, scheduled to start hitting the market this fall with all GM electric vehicles using the platform by 2022. GM will not be using LFP for Ultium. Instead, they will use the new LG Chem NMCA chemistry with 89% nickel. The resulting battery pack should have an energy density of greater than 200 Wh/kg. Certainly, this is more expensive than LFP but using the NMCA and Ultium technology, GM expects to achieve the highest range possible with Li-ion and to be cost effective considering the high energy density (performance) of the pack.

GM expects to achieve the highest range possible with Li-ion batteries.

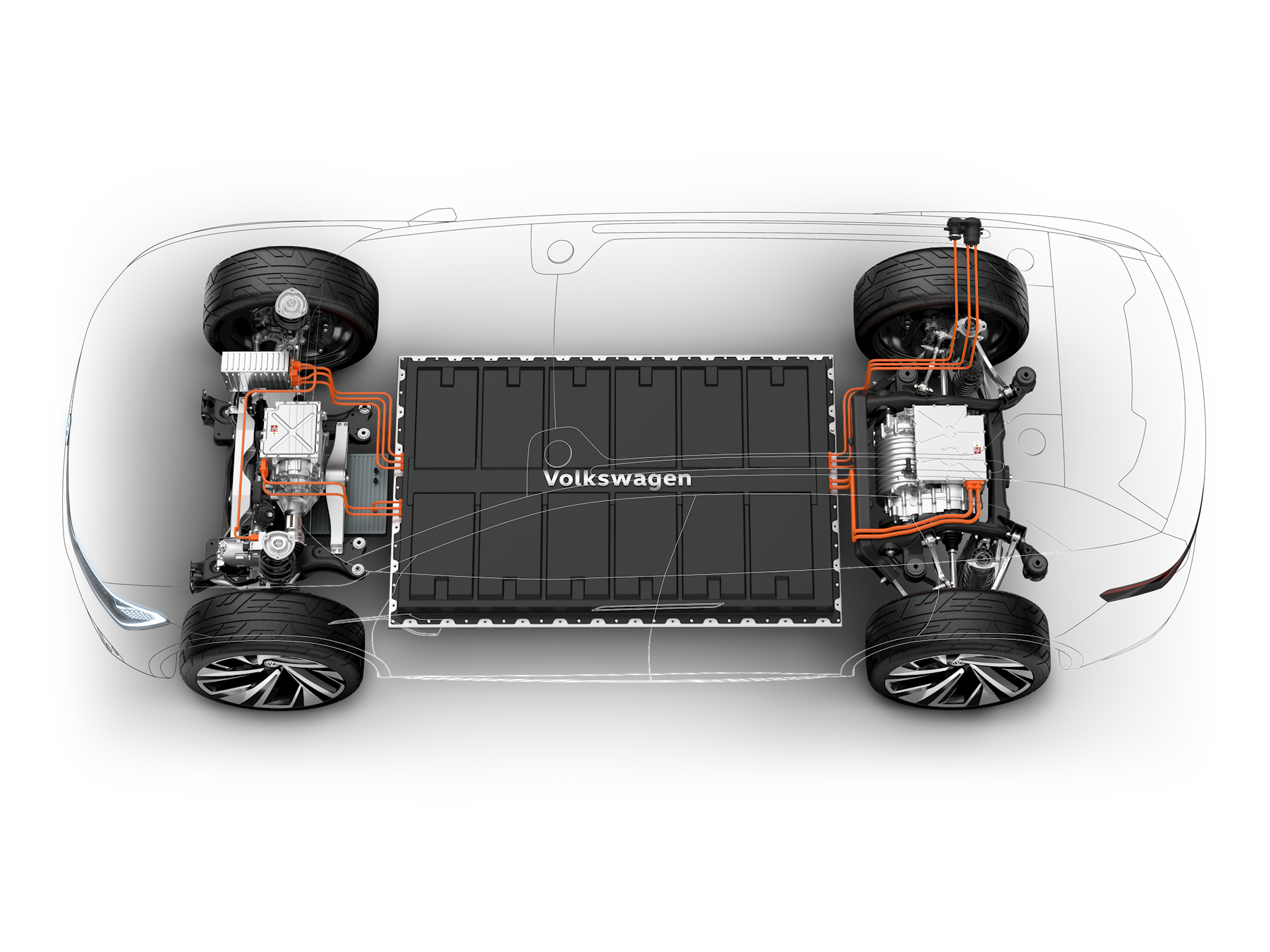

Volkswagen is also starting to use what they call their Modular Electric Drive Matrix (MEB), which similar to CTP and Ultium has large prismatic cells, high utilization efficiency and lower cost architecture.

The use of LFP in electric vehicles is increasing due primarily to its low cost, but the question is to what extent?

Technologies of choice

It is clear that LFP technology will be popular in China and perhaps other Asian countries where cost is the driving factor. Also, it is expected that the number of small two- and three-wheeled vehicles will have strong growth in these areas where cost matters most and LFP will be used.

In addition, LFP is finding its way into Brazil via VW for delivery trucks and in Europe for buses.

At the same time, the appetite for large high-performance vehicles will stay strong. CATL, SK Innovations, LG Chem and others will provide high nickel batteries for electric vehicles in Asia, Europe and North America. NMCA, NMC811 and other high nickel chemistries will be the performance choice and with the lessening of cobalt content, they will also be the lowest cost of nickel-containing Li-ion.

Outlook

What is expected for the future are two main technologies; low cost LFP and high performance (high nickel) NMC. Analysts BNEF, Roskill and others do not fully agree on the market share of the two technologies. The predicted percentages of LFP batteries in EVs of the future range from 15% to 40% by 2030.

It is unclear at this time where the needle of cost versus performance will end up and how this will translate into EV battery technology. But for the foreseeable future, it looks like only a quarter of new electric vehicle models built in China will be LFP, compared to 76% for NMC/NCA.